Summary

Uncertainty is a part of the monopoly game in any economy. That is why investors always seek assets that offer stability in difficult times. When it comes to stability, investment in gold rarely disappoints. It can be one of the wisest decisions you can make as an investor. In this blog, we will explore the 7 benefits of Gold Investment during economic uncertainty in the USA.

Introduction

Market trends can quickly take you from rags to riches or vice versa. Because investments are subjected to market risks. So you should read the scheme-related documents carefully before investing. In comparison, gold is still considered as a safe-haven asset. It attracts investors because of its rich history and gold standard resilience. Gold has consistently performed well whenever the equity market showed a downward trend or geopolitical issues affected the inflation rate. Hence, investors always turn to gold during unpredictable times.

With rising inflation rates, stock market fluctuations, and intense geopolitical tensions, a stable investment option is necessary. Hence, gold is a popular choice for safeguarding wealth. Here is ‘the why’ behind it.

1. Hedge against inflation.

Inflation is the buzzword of the economy. It is something that everyone keeps talking about without understanding it completely. Although controlled inflation can be good for the economy, it can reduce your purchasing power and eat your savings. In a fiat currency system, it increases the cost of living, making goods and services expensive.

On the contrary, gold’s intrinsic value tends to increase when the purchasing power of the dollar declines. Hence, during inflation, the demand for gold goes up as it serves as a hedge against it. For example, In the ’70s, when inflation was high, the price of gold surged from $35 in 1971 to $800 in 1980.

When the dollar loses its shine, all that glitters is GOLD.

2. Safe-Haven asset in turbulent times

When things get rocky in the financial world, gold shines as a safe-haven asset. As the bear market trends or geopolitical issues intensify, investors often seek financial refuge in gold because of its rich history and value.

For instance, during the COVID-19 pandemic and the 2008 financial crisis, gold prices continued to rise as investors turned to it for security. Hence in turbulent times, gold is considered as a G.O.A.T of investments.

3. Portfolio Diversification

The golden rule of investing is to not keep all of your eggs in one basket. Since gold has a low correlation with traditional assets like stocks, bonds and mutual funds, it reduces the overall risk of a portfolio. Hence investing in gold can make any portfolio attractive.

Gold acts as an illustrious stabilizer. It can balance out the potential losses in other investments. Hence, Including gold in your portfolio is a great way to absorb the shocks of a volatile market.

4. Liquidity

When it comes to making smart investment decisions, liquidity is an important factor to consider. Although gold has a high melting point, as an asset it offers great liquidity. Whether you own a piece of physical gold like coins and bars, or invest through ETFs, it can be easily converted into cash. And thanks to its golden allure, you can easily sell it in the market as well.

Other assets can lose their value overnight or take some time to offload. On the contrary, gold offers a great peace of mind knowing that you can cash out whenever needed.

5. Golden shield against currency depreciation

Although all the countries follow the fiat currency system, gold has maintained its high standards. When it comes to value, gold and paper currency mostly share an inverse relation. This inverse relationship means when the dollar loses value, gold prices tend to rise.

As the import-export equation also affects the value of currency, when gold prices are on the rise countries that export gold have a strong currency. Hence investors use gold as a shield against currency fluctuations. It is a great way to secure your wealth in an uncertain economy.

6. Resilience of Gold

When it comes to being resilient in tough times, gold is an undisputed champion. It has an excellent track record of soaring high during economic downturns. During the 1970’s stagflation when economic growth was sluggish and inflation was high, the price of gold increased consistently.

Gold has turned out to be a key asset in recession-proof portfolios. During the recession of 1973-75, the price of gold continued to rise. In 2008, when the market crashed, the price of gold achieved new highs. The price increased from $700 to $1200 per ounce by 2009. The recent hike in gold prices during the pandemic further strengthens its reputation as a risk-proof asset. Hence, investing in gold is like an economic disaster insurance.

7. Supply-Demand dynamics

Unlike the supply of paper currency in the fiat system, gold is finite. Money can be printed by the government based on the state of the economy. Hence its value keeps on changing. Gold’s scarcity and limited supply make it a valuable asset. Hence gold never loses its charm as a precious metal.

Even after so many years, gold is still considered a symbol of wealth. As long as people love playing status games, gold will always be an attractive investment. The fact that central banks hold gold reserves further adds value to gold investment.

Now that we know the WHY behind the lustrous appeal of gold, let us get to the HOW of gold investment.

Golden alternatives

To grow and protect your wealth with gold, consider these four golden options.

1. Physical Gold

Physical gold comes in the form of coins, bars and jewellery. It gives you a direct exposure to the asset. However, it involves storage and insurance costs.

2. ETFs (Exchange Traded Funds)

If you don’t want the hassle of storage and security, gold ETFs are an easier way to invest in gold. They track the price of gold and can be traded like stocks.

3. Gold Mining stocks

Investing in companies that mine and produce gold is another option for gold investment. The return on investment in this case depends on the success of the company. Hence there is an element of risk involved in it.

4. Gold futures and options

If you are an investor who has a knack for predicting outcomes then you might want to place your bets on gold futures and options. These tools allow you to speculate on future gold prices. This is more suitable for experienced investors.

Recent trends in Gold prices

When it comes to investment, past performance is a great metric to make an informed decision. Since data never lies, here are the recent trends in gold prices that might help.

1. Pandemic impact

During the initial phase of covid 19, gold prices marked record highs. It reached around $1800 per ounce which was a result of high economic uncertainty in the pandemic.

2. Recent inflation

In June 2022, when inflation spiked, gold prices marked an all-time high. Although the inflation rate declined in the next two years, gold prices on average remained stable. As of 2024, gold prices are relatively high.

3. Geopolitical events vs Gold

Gold is often considered a safe harbour during geopolitical tensions. During the Russia-Ukraine conflict, gold prices increased significantly due to substantial market volatility.

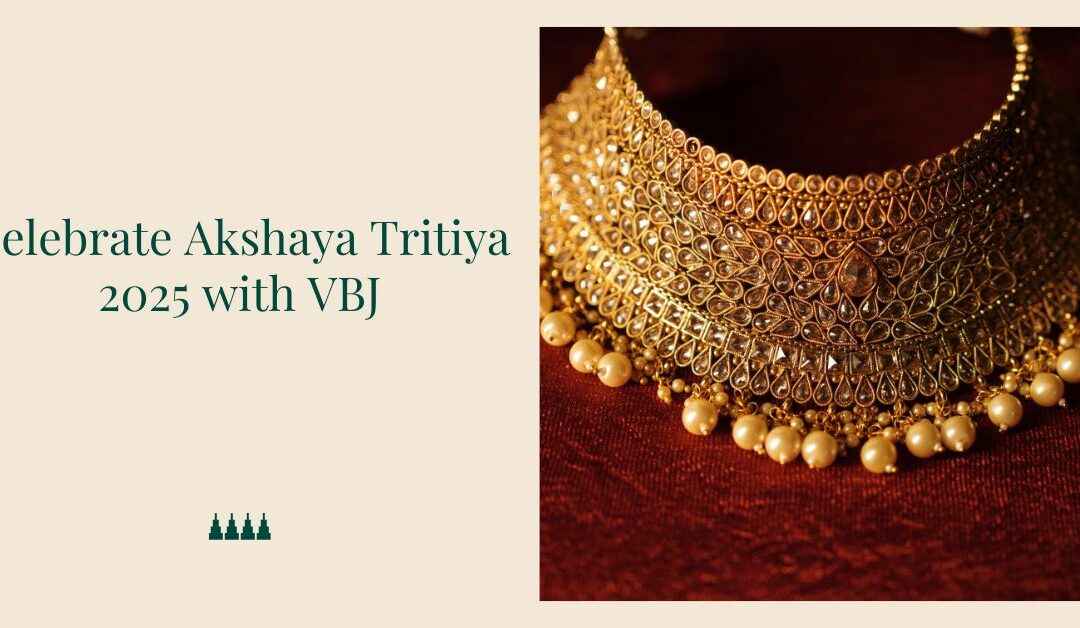

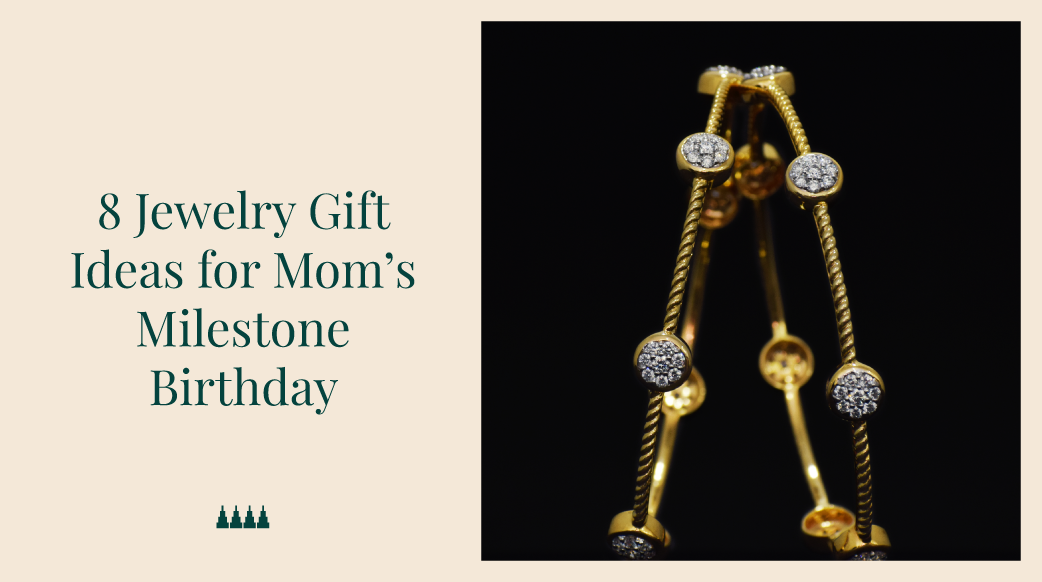

Vummidi Bangaru Jewellers: Your destination for the finest gold

The legacy of Vummidi Bangaru Jewellers dates back to 1900. At VBJ the art of jewellery making is a tradition that is defined by quality, design and authenticity. Founded in 1900, we have earned a reputation for blending style and substance.

VBJ is your one-stop shop for the finest gold collection. We offer everything from bracelets, and necklaces to wedding rings in certified gold standards. Since trust is at the core of our brand values, all our products come with a 100% authentic certificate. Although we take a lot of pride in our craftsmanship, we value customer satisfaction more than silver and gold.

Golden Words

Economic uncertainty is inevitable but being prepared for it doesn’t have to be. That is why it is important to understand the game and play it right. Gold with its reputation for stability, liquidity and resilience can be a great asset to get maximum returns in this real-life monopoly game. Whether you are a seasoned investor or a newbie trying to learn the tricks of the trade, gold can be an integral part of your investment journey.

When the market crashes or inflation shoots up, gold offers a peace of mind that is hard to find. It acts as an anchor in turbulent times. So, next time when the financial world goes upside down, make sure that your portfolio is shining because of gold.

| For Latest Updates and Trends Checkout Official Vummidi Bangaru Jewellers Instagram Page |

FAQ – Benefits of Gold Investment

1. What is the biggest advantage of investing in gold?

Gold investment is a secure way to protect and generate wealth simultaneously. It reduces the risk and can be a great long-term investment.

2. What are the different ways to invest in Gold?

You can invest in gold by buying gold coins, bars or jewellery. For non-physical investments, you can buy gold ETFs.

3. Why should I include gold in my investment strategy?

Gold offers a hedge against inflation. Compared to stocks and other assets, it provides better stability with good returns. It can also make your portfolio risk-proof.

4. How much percentage of investment should be allocated to gold?

The percentage of allocation depends on your risk appetite and financial goals. Many financial advisors suggest 5-10% of investment in gold.

Store Locator

Store Locator

0 Comments