Summary

Why have the gold prices seen a tremendous increase since the start of 2024? The relationship between the US economy and gold prices is decided by a number of factors. This blog will help you understand seven keyFactors driving gold prices in the US in 2024.

Introduction

The country of America has always been associated with gold. The 19th century was a pivotal moment for gold—it was the era of the California Gold Rush. This was a pivotal moment that stabilised the gold market to the benefit of the US economy. Mass immigration from around the world followed.

People flocked to the United States in hopes of finding gold fields and securing their version of the American Dream—and they still flock from all over the world to make that dream a reality. This contributed significantly to the expansion of the US market.

However, the gold rush was just the beginning. That golden boom set off a chain of events that has diversified into the bustling gold market of the modern day.

Gold was the safest purchasing decision a person could make in the 20th century. Why? Gold prices have a habit of increasing over time. Moreover, gold jewellery items are exceptional fashion pieces that stay in style no matter the trend.

If an emergency arises, gold can be sold quickly to make money and meet needs—gold becomes a safe haven for everyone.

That trend has shown no signs of slowing down in the 21st century. Gold still remains as valuable, if not more, as in the time of the Californian Gold Rush.

Investors still place time and focus on obtaining gold to protect their investments. Even the government has started making decisions to purchase more gold. The demand is at a peak now in 2024. This has affected the market prices considerably.

Let’s take a look at the current gold market scenario in the USA.

An Overview of the Current Gold Market in the USA

The price of gold in the US market is around $2600 per ounce as of October 2024. The volatility in the gold market is evident from the growth that the prices have witnessed since the start of 2024.

Let’s take the price history between January 2020 and January 2024 as an example. In early 2020, gold price stood at $1550 per ounce. Within four years, the price climbed at a decent rate to around $2060 per ounce by the beginning of 2024. This is an impressive 32% growth; all in all, it gives an annual growth estimate of 8%.

Considering the US economy’s inflation, this growth rate is fair. It’s not extraordinary, but it’s better than expected. However, things have taken a turn since the beginning of 2024.

The price of gold went from $2060 per ounce in January to a whopping $2650 per ounce by October. A 10-month growth rate has surpassed the entire growth rate of the last four years!

Considering the current dynamics of the US market, the price is expected to increase even further. Whether you are an investor or a consumer planning to buy gold, to ensure that you are making the best purchasing decision, knowledge of some factors that drove gold prices this year can be helpful.

This blog will underline the 7 key factors that led to the surge in gold price in the US market this year.

7 Factors Driving Gold Prices in the US Market This Year

1. Concern of Inflation

The past decade has seen inflation levels hitting record levels in the US economy. The consumer price index (CPI) hit a level of 9.1% in June 2022, which is an all-time high in the last forty years. The current inflation trend in the US is somewhat comforting, considering the history of previous years.

However, people are motivated by the errors of their past. The fear that the economy might slump into inflation soon is prevalent. This psychological fear has a huge impact on investment decisions. People are more likely to purchase and invest in those assets that have stood the test of time.

Gold is such a precious metal. No matter the economy, gold prices were relatively stable even during the worst periods, and they had a habit of jumping back up soon. This makes gold a safe investment opportunity in the minds of investors.

All in all, the inflation concern is driving people to buy more gold, thus increasing demand and, hence, the market price.

2. Geopolitical tensions

Economic decisions taken in other foreign countries can influence the prices of gold in the US. Ongoing global conflicts have led to the fear of an impending war. The US government has continued its economic support throughout the history of this Middle East war.

Another all-out war would mean that the government would have to allocate more resources to fight the war. This can create uncertainties about the stability of a country’s economy.

If we take a closer look at historical trends, war is a time when people crave a haven of stability—that heaven has always been gold. Gold has been a haven for consumers since the initial gold rush phenomenon in the 1800s. Thus, the price hike and increase in demand for gold can be attributed to geopolitical tensions.

3. Value of the US dollar

In general, the price of the US dollar is inversely related to the cost of gold. This means that as the dollar price goes down, the price of gold increases accordingly.

The US dollar has declined approximately by 4% since July. The trade deficits and monetary policies of the government are marked as being the major reasons for this decline.

In response to the decline of the US Dollar, the gold market has subsequently increased its price to counter adverse economic effects. The relationship that the US dollar has with other foreign currencies, such as Euro and British Pound, can also affect the prices of gold.

The volatility of the US dollar can be a driving factor that attracts more investment into gold assets, leading to price increases.

4. World Wide Demand for Gold Jewellery

Gold is a universal precious metal that has been used to manufacture ornaments in different cultures around the world. Necklaces, Bracelets, Rings, Earrings—It doesn’t matter what the accessory is; in one way or another, you can use gold to heighten its appeal.

Recent global markets have seen a tremendous increase in people’s purchasing power in developing countries. Everyone is trying to get their hands on gold jewellery either as an investment method or as a classic and timeless accessory.

The gold supply, which was previously concentrated towards world powers like the US, is now being shared with other rising economies. Thus, there is a higher demand for gold and a shortage of gold everywhere.

5. Gold Production

Another factor that led to the shortage of gold was the interruption in its production. A few decades back, there were many mines that were freshly discovered in countries like Russia and China that were able to sustain a reliable supply of gold worldwide.

In recent years, we have seen stagnation and, in some cases, a reduction in gold production. According to the data provided by Investopedia, gold mine production has decreased by around 300 metric tons year by year since 2019. Many existing mines in countries like China and Peru have now completely exhausted their resources.

The newly introduced sustainable mining laws are a headache for mining industries since it costs more to produce gold now than ever before. A combination of all these factors has led to an increase in worldwide demand for the precious metal, thus hiking the price.

6. Interest Rate Cuts

The US Federal had announced a federal rate cut on September 18, and the reaction that followed saw a huge hike in gold prices. How can low interest rates affect the gold prices?

Well, the rate cut simply means it offers an opportunity for banks to lend money to each other at a lower interest rate. This was taken as a decision by the US government to tackle inflation and dollar devaluation.

A low interest rate means investors have limited access to increase their profits from investments. So, naturally, people will start searching for alternative forms of investments—and gold is a leading contender as an alternative.

These government-level decisions can start a chain reaction, ultimately causing a hike in gold prices.

7. Increased Central Bank Purchases

Investors also follow the purchase patterns of Central Banks. This is because their decisions almost always signify low-risk, long-term gain investment opportunities.

The first quarter of 2024 alone saw a huge increase in the amount of gold purchases by the central bank. The increase of 290 metric tonnes of gold is 69% more than what the banks have been holding for the last five years.

According to the World Gold Council, countries like China, Turkey, and India have been following these investment patterns. Investors are taking note of this, and the demand for gold has been increasing ever since.

Buy Gold in America from Vummidi Bangaru Jewellers

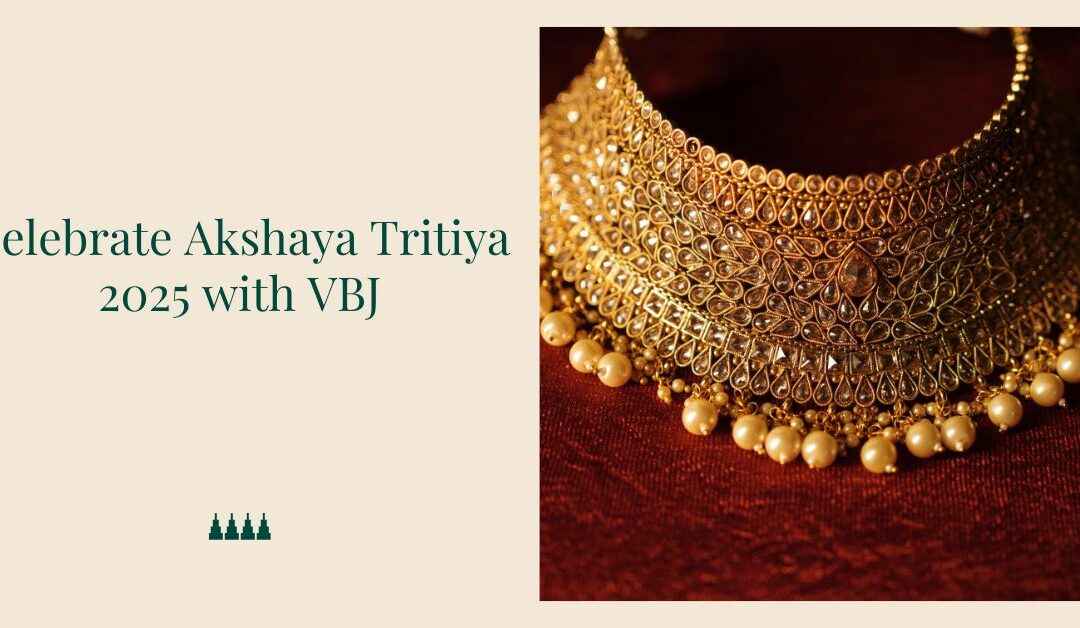

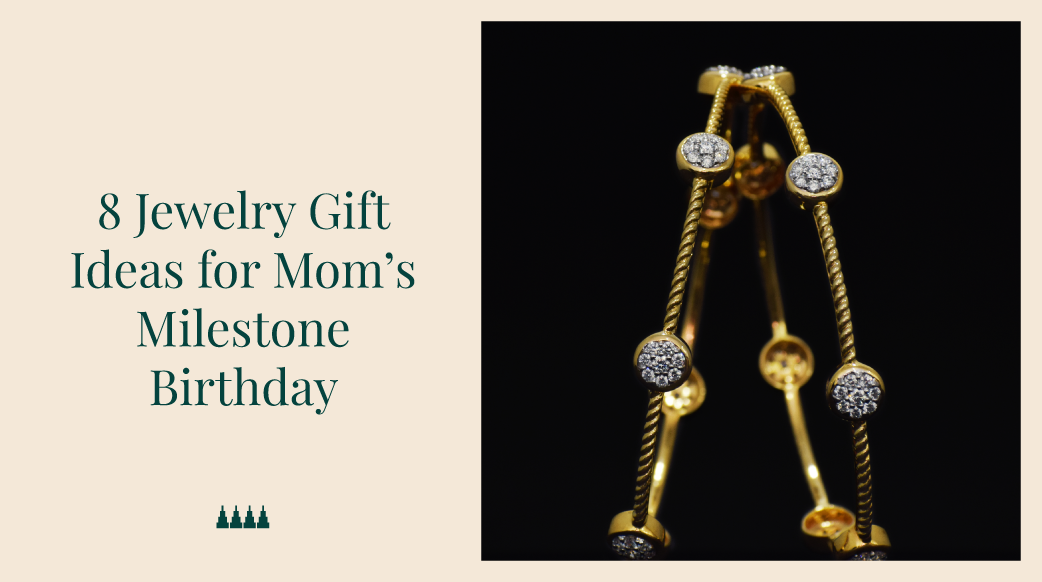

Vummidi Bangaru Jewellers is the home of South Indian decadence. Our legacy is steeped in tradition and quality that goes as far back as 1900 in the beating heart of Chennai, India.

We have over 100 years of successful craftsmanship in the jewellery space. Our exquisite collection of ornaments includes but is not limited to diamond, gold, platinum, ruby, emerald, and other precious materials. No matter the occasion, no matter the person, we guarantee that we have something to offer to satisfy everyone.

Our US store brings the highest quality gold ornaments designed using traditional Indian craftsmanship. Now, you can wear pure gold ornaments without compromising your fashion.

Trust in the legacy of Vummidi Bangaru Jewellers.

Come visit our offline stores and experience the quality that we offer.

Takeaways

- The year 2024 has seen a tremendous increase in gold prices that beats all records of the last 40 years.

- Inflation concerns are making people choose gold as an option for investment.

- Geopolitical conflicts are also driving the gold price in the US

- Increased demand and reduction in gold supply contribute to the price hike.

- Several government policies, such as interest rate cuts and increased purchases by centralised banks, have affected the market price.

| For Latest Updates and Trends Checkout Official Vummidi Bangaru Jewellers Instagram Page |

FAQ’s – Factors Driving Gold Prices in the US

1. What factors influence the gold prices in the US?

Many factors, such as inflation trends, the value of dollars, interest rates, investment decisions, and geopolitical policies, can affect gold prices in the US.

2. What is the historical trend of gold prices in the US?

Historically, gold prices have been on a sharp increase since the 1970s. The growth in 2024 has been tremendous and is expected to break more records.

3. How does inflation affect gold prices?

Inflation changes investment decisions. People will look for relatively safe options that could return decent profits. Gold is a great option for hedging against inflation.

4. How does the demand for gold affect jewellery prices?

An increase in demand can strain existing supply levels. Thus, gold jewellery prices can be expected to increase.

5. Can government policies affect gold prices?

Yes, government policies, laws, and decisions can affect gold prices. The recent federal cut of interests is a good example.

Store Locator

Store Locator

0 Comments