Summary

Much like elsewhere, the gold market in the USA faces an array of challenges that shape its current landscape. While gold remains a significant asset for investors seeking stability in volatile times, the industry must navigate complex issues ranging from environmental concerns to political instability. This blog will discuss the key challenges confronting the gold market in detail, offering insights into major challenges facing the gold market In the USA.

Introduction

Gold has historically symbolised wealth and a stable investment in uncertain times. In recent years, the gold market has experienced fluctuating prices driven by various factors, including economic conditions, geopolitical events, and shifts in investor sentiment. However, beneath these surface-level dynamics lies a set of deeper, more entrenched challenges that shape the future of the gold industry.

We will discuss about six major challenges facing the gold market in the USA today, examining their implications and potential solutions.

The US Economy and the Gold Market

The USA has a long-standing relationship with gold, both as a reserve asset and a commodity. The gold market significantly influences the country’s economic stability and growth. Gold prices often rise during economic uncertainty, providing a hedge against inflation and currency fluctuations. In times of financial turmoil, investors flock to gold as a safe haven, driving up demand and prices. Conversely, a strong economy can lead to lower gold prices as investors seek higher returns on other assets.

Gold’s Role in the US Economy

Gold plays a multifaceted role in the US economy:

- Reserve Asset: Central banks, including the Federal Reserve, hold gold reserves as a measure of economic stability.

- Investment: Gold is a popular investment vehicle for individuals and institutions, providing portfolio diversification and a hedge against inflation.

- Industrial Use: Beyond investment, gold is used in various industries, including electronics, medicine, and aerospace.

Impact on Financial Markets

The gold market’s fluctuations can significantly impact financial markets and investor sentiment. A surge in gold prices often signals economic uncertainty, while a decline suggests confidence in economic growth and stability. Understanding these dynamics is crucial for policymakers, investors, and businesses navigating the complexities of the gold market.

Major Challenges Facing the Gold Market

1. Environmental and Climate Pressures

The gold mining industry faces increasing scrutiny over its environmental impact. Mining activities contribute to greenhouse gas emissions, deforestation, water pollution, and ecosystem disruption. As global awareness of climate change grows, there is mounting pressure on mining companies to adopt sustainable practices.

Several initiatives aim to mitigate the environmental impact of gold mining:

- Renewable Energy: Transitioning to renewable energy sources for mining operations reduces carbon emissions.

- Water Management: Implementing water recycling and treatment systems minimizes water usage and pollution.

- Rehabilitation: Restoring mined areas to their natural state helps preserve biodiversity.

2. Regulatory and Permitting Issues

Obtaining permits for new mining projects is becoming increasingly complex and time-consuming. Regulatory frameworks vary across states, and navigating these processes can be challenging for mining companies.

Effective strategies for managing regulatory and permitting issues include:

- Stakeholder Engagement: Collaborating with local communities, governments, and environmental organisations to address concerns and build support.

- Transparency: Maintaining transparent operations and reporting practices to build trust with regulators and stakeholders.

3. Resource Nationalism

Resource nationalism refers to governments demanding a larger share of mining profits through increased taxes, royalties, or direct ownership. This trend is driven by a desire to maximize the economic benefits of natural resources.

Mining companies can navigate resource nationalism by:

- Negotiating Fair Agreements: Engaging in fair negotiations with governments to ensure mutually beneficial terms.

- Corporate Social Responsibility: Demonstrating commitment to local communities through social and economic development initiatives.

4. Political Instability

Political instability in mining regions can disrupt operations and create security risks. Conflicts, corruption, and changing government policies can significantly impact the gold market.

Strategies to mitigate political risks include:

- Diversification: Investing in mining projects across multiple regions to reduce dependency on any single location.

- Political Risk Insurance: Purchasing insurance to protect against losses from political events.

5. Declining Reserves

The discovery of new major gold deposits is becoming less frequent, raising concerns about the long-term supply of gold. Declining reserves can lead to increased exploration costs and lower production levels.

Efforts to address declining reserves involve:

- Technological Innovation: Developing advanced exploration and extraction technologies to access deeper or previously uneconomic deposits.

- Recycling: Increasing the recycling of gold from electronic waste and other sources to supplement primary production.

6. Health and Safety Concerns

Mining remains a hazardous industry, with workers facing risks such as accidents, exposure to harmful substances, and harsh working conditions. Ensuring the health and safety of workers is paramount.

Improving health and safety standards involves:

- Training and Education: Providing comprehensive training programs to equip workers with the knowledge and skills to operate safely.

- Safety Technology: Implementing cutting-edge safety technologies, such as remote-controlled equipment and real-time monitoring systems.

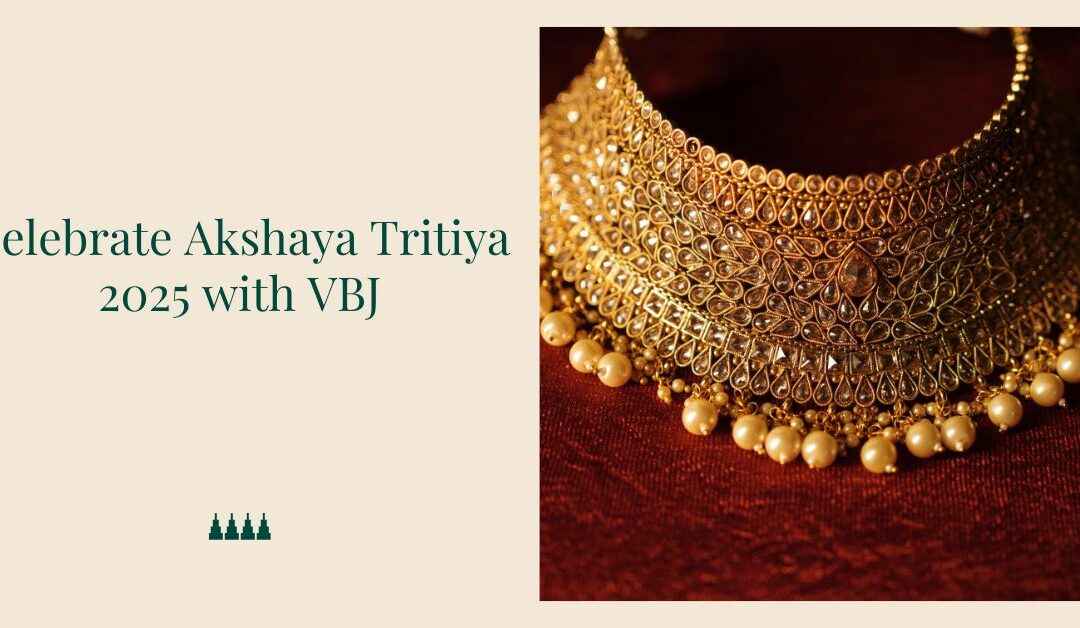

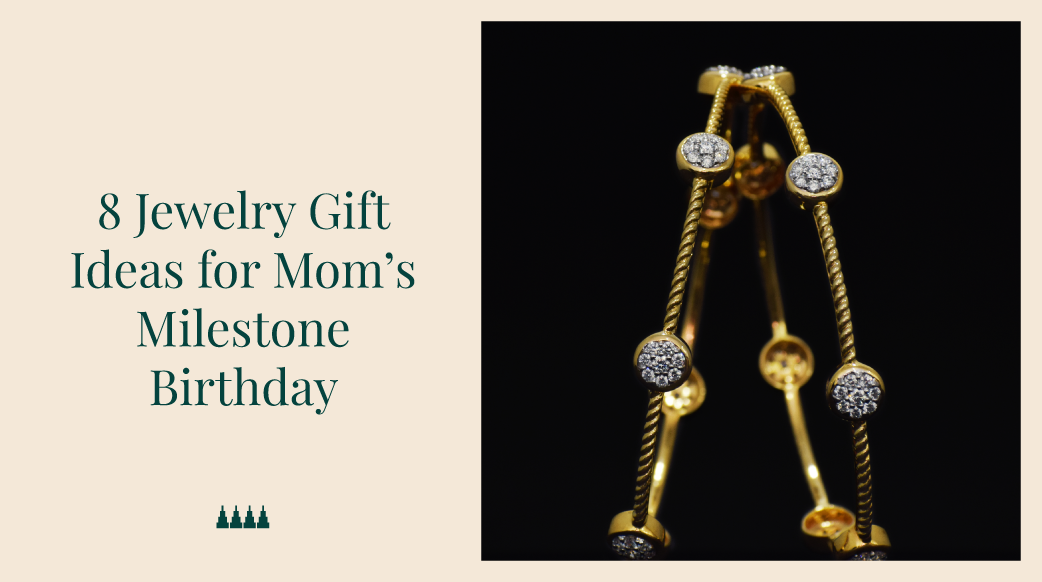

VBJ: Heritage in Every Design, Excellence in Every Detail

At Vummidi Bangaru Jewellers, we take immense pride in offering exquisitely crafted jewellery that seamlessly blends tradition with modernity. Drawing on generations of expertise, our designs feature the finest diamonds and gemstones, sourced with integrity and precision. Our unwavering commitment to ethical practices, superior craftsmanship, and timeless elegance have solidified our reputation as a premier destination. At Vummidi Bangaru Jewellers, heritage meets innovation to create treasures that last a lifetime.

Visit us to explore a world of unparalleled craftsmanship and timeless elegance!

Conclusion

The gold market in the USA faces significant challenges that shape its future trajectory. Environmental and climate pressures, regulatory complexities, resource nationalism, political instability, declining reserves, and health and safety concerns all require careful management and innovative solutions. By addressing these challenges, the gold industry can continue to play a vital role in the US economy, providing stability, investment opportunities, and industrial applications.

As the industry evolves, it is essential to balance economic interests with environmental and social responsibilities. Embracing sustainable practices, engaging with stakeholders, and investing in technological advancements will be crucial for the gold market’s resilience and long-term success. Ultimately, responsible AI design and strategic management can ensure that the gold market thrives while promoting a more equitable and sustainable future.

| For Latest Updates and Trends Checkout Official Vummidi Bangaru Jewellers Instagram Page |

FAQs – Major Challenges Facing The Gold Market

1. What are the main environmental concerns associated with gold mining?

Gold mining has several environmental impacts, including greenhouse gas emissions, water pollution, deforestation, and habitat destruction. Mining companies are under pressure to adopt more sustainable practices to mitigate these effects.

2. Why are declining gold reserves a concern for the industry?

The discovery of new major gold deposits is becoming less frequent, raising concerns about the long-term supply of gold. This can lead to increased exploration costs and lower production levels, impacting the market’s stability and growth.

3. What role does technology play in addressing declining gold reserves?

Technological innovations in exploration and extraction techniques can help access deeper or previously uneconomic gold deposits. Recycling gold from electronic waste and other sources also contributes to supplementing primary production.

4. What measures are taken to enhance worker safety in the mining industry?

Mining companies invest in comprehensive training programs, implement advanced safety technologies like remote-controlled equipment, and conduct regular safety audits to enhance worker safety and minimise risks.

5. How does political instability in mining regions affect the gold market?

Political instability can disrupt mining operations, creating security risks and uncertainty for mining companies. This can lead to interruptions in production and increased costs related to security measures and insurance.

Store Locator

Store Locator

0 Comments