Summary

If you’re not investing your money, then you will not be able to beat the inflation. While there are many places that you can invest your money including real estate, mutual funds, stocks — the safest bet for you is gold.

However, time and again, we see that most people make common mistakes while choosing to invest in this commodity. This article will break down common mistakes to avoid when investing in gold

Introduction

Investing in physical gold is a great way to protect your financial future. Earlier it was considered a status symbol, but now it is considered a good investment option. It has become investors’ preferred investments because of the massive increase in gold prices in recent years.

This is the sole reason people have started investing in the yellow metal – but the other side of the story is – it does have some inherent risks due to the turbulent global economic climate. Gold investors have to be really cautious since they are not aware of where and how to begin. There are many costly mistakes one can make.

Portable and easy to trade, gold has always been a popular choice for investors. As every investment has its own pros and cons, let’s dive into the common mistakes people may make while investing in gold.

1. Traded Funds or ETFs is not the only way

Physical Gold is considered to be the right choice against Traded Funds or ETFs. A Gold Exchange Traded Fund (ETF) is an investment vehicle that tracks the price of physical gold and allows investors to gain exposure to gold portfolios without owning the metal. They are like gold stock exchanges that can be bought and sold continuously at market prices. Instead of a return on investment in your hand you will have a paper full of clauses and conditions. Physical gold in the form of bars, jewelry, coins etc are always better.

2. Invest at the right time

Timing matters for any kind of investments and the same goes for Gold. Do your homework before buying Gold. For example –

- The month will matter – if it’s the wedding season or a festival like Diwali – the prices will be too high. And if it’s the month of “Shradh” – the rates may be lower as compared to the wedding season.

- Watch out for a financial crisis or market crash or any war or communal riots going on.

A thorough research to understand the market is required to have an idea of when the prices are likely to fall or rise. Purchase or invest in gold when the market is favorable for you to get a fair price on your investment. Though it’s always better to buy when the prices dip, it is a good way to maximize your return on investment. And moreover don’t panic if you notice a drop in prices after purchasing gold. Gold prices are volatile and will continue to fluctuate. Prices are likely to recover in the long run, so have patience.

3. Don’t get duped

Gold is a valuable investment and one should invest with a thorough analysis. It’s your hard earned money, you have to be very cautious.

The investors have the money to buy gold, but they may not have the knowledge from where, whom and when to buy. In a world of next-day deliveries, some investors get attracted by the convenience of buying gold online. There are many online platforms, where gold is sold and bought, but you cannot rely on their genuinity. They may provide you with offers to buy gold in bulk at a lower rate – BEWARE, you should avoid such platforms.

You cannot judge the genuinity of the gold through online purchase. Not only on online sites, there are many scammers in the market ready to mislead you. So, it is necessary to conduct research about reputable gold sellers and platforms before investing in gold. It may be exhausting, but it is extremely beneficial. Know the dealers, check their rates, and choose the one that provides pure gold at the best price.

4. Don’t buy in small quantities

Manufacturing costs are levied on any gold product you purchase. It is called the “Making Charges” that causes around 10% reduction in your investment. The making charges are quoted according to the workmanship on gold. Therefore, coins, small bars or jewelry are usually not considered investments. When your goal is investments, buy gold of substantial size in the form of bars. The production costs will be lower for huge bars when compared to smaller units. Besides, you can make a good profit in the future when you want to re-sell it.

5. Don’t consider Gold as a short-term investment

When you are planning to buy gold for investments, keep in mind that it is not a short term investment. Yes, It’s true gold is a good investment and gives a good return, but – it is not a daily, weekly or monthly income generating asset. Investors should be prepared that they have invested in gold to hedge against inflation and safeguard their wealth.

It may take some time before it makes profits. However, they can still sell gold whenever required, as for sure it will give a good return at any point. Thus, it is not advisable to invest only in gold, it can leave you exposed to significant risks. Diversification in investments helps spread risk and reduce the impact of losses.

6. Other expenses

Investors invest in gold to gain income but forget to calculate the inherent expenses. Gold investments are done for good returns but storing or safeguarding them is another task and expenditure. There are two ways of storing gold – either keep it yourself or have someone else do it for you. Each alternative has pros and cons.

- When you are planning to store gold on your own it is quite risky. And if it gets lost or robbed, it’s gone for good.

- Investors find it safer to hire a vault to keep the physical gold, that is again an expenditure and is automatically considered deducted from the income gained.

- It is always safe to take insurance for the gold investments, though the insurance is another required expenditure against the income.

Weigh your options and choose the best choice.

7. Hire an advisor for gold investments

Identify an expert who can be a great advisor in gold investments. They have the expertise to identify investment risks and rewards to create an effective strategy. They will help you decide on the right amount of gold stocks to invest and the right time to sell them. During economic uncertainty or significant life changes, a trusted advisor can be valuable. They can provide you guidance, support, and a steady hand to navigate through even the most challenging financial situations. And you never know with the help of their strategies you may gain good returns during uncertainty too.

8. Hold your emotions

Investment is business and it should not be ruled by emotions. Impulsive decisions based on short-term market fluctuations or following the crowd without proper analysis can lead to poor investment choices. Don’t let fear or greed affect your investment decisions. You may sell the gold in greed when the prices soar up suddenly or sell them in fear if the prices decrease without any reason. In both situations you may regret later. Buy or sell when your goals change or you are in a financial crisis. Don’t buy or sell gold because you are overly confident or are scared.

These are the common mistakes done by a common man while or before investing in gold. Do go through the mistakes before your investments.

Different ways to invest in gold

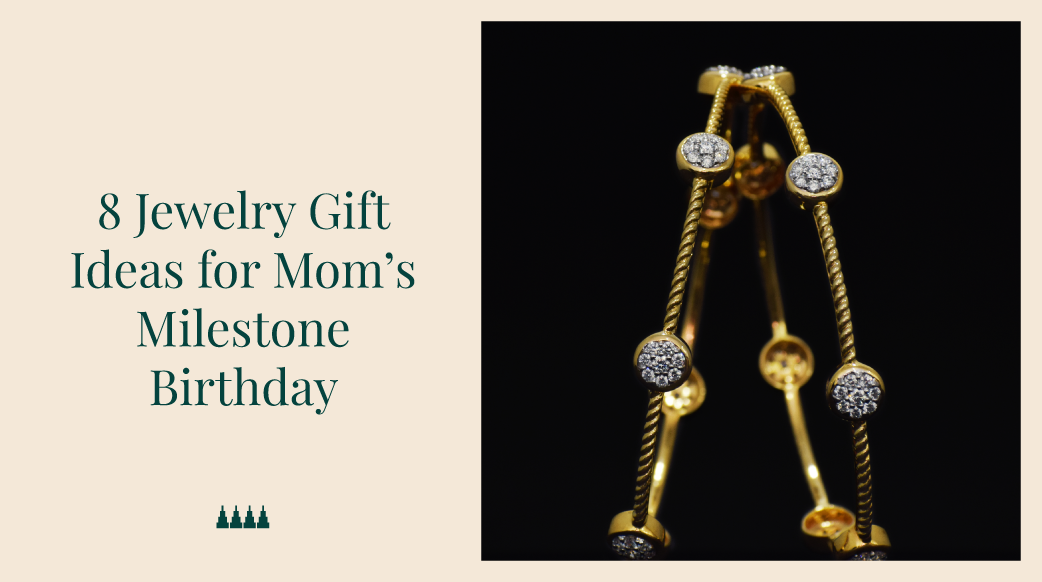

- Physical Gold: The most popular and satisfying method of investing in gold. Physical gold Investment can be in the form of jewelry, gold bars and coins.

- Sovereign Gold Bonds: It’s an alternative way to invest in gold issued by the government. The sovereign gold bonds are supervised by the Reserve Bank of India. These are tax-free and can be purchased through various platforms.

- Digital Gold: It works similarly to stocks where you invest your money and receive a unit of gold in your digital account. You can keep it for as long as you want and sell it when you think the time is right. There are numerous trustworthy platforms where you can buy gold digitally. While selling the gold, the company will take a percentage of the transaction.

- Gold ETFs: Gold ETFs are gold-investing mutual funds. Just like stocks investing in Gold ETFs allows you to buy a portion of it in your Demat account. Except for some brokerage fees, there are no charges to buy or sell Gold ETFs.

- Mining stocks: This could be an excellent way to invest in gold as you are directly investing in the manufacture of this valuable asset. The benefits are shared by both the manufacturer and investor when the prices rise up high. The investor gets a good return and the manufacturer can double its production when the investor invests more.

The best place to buy gold for investments

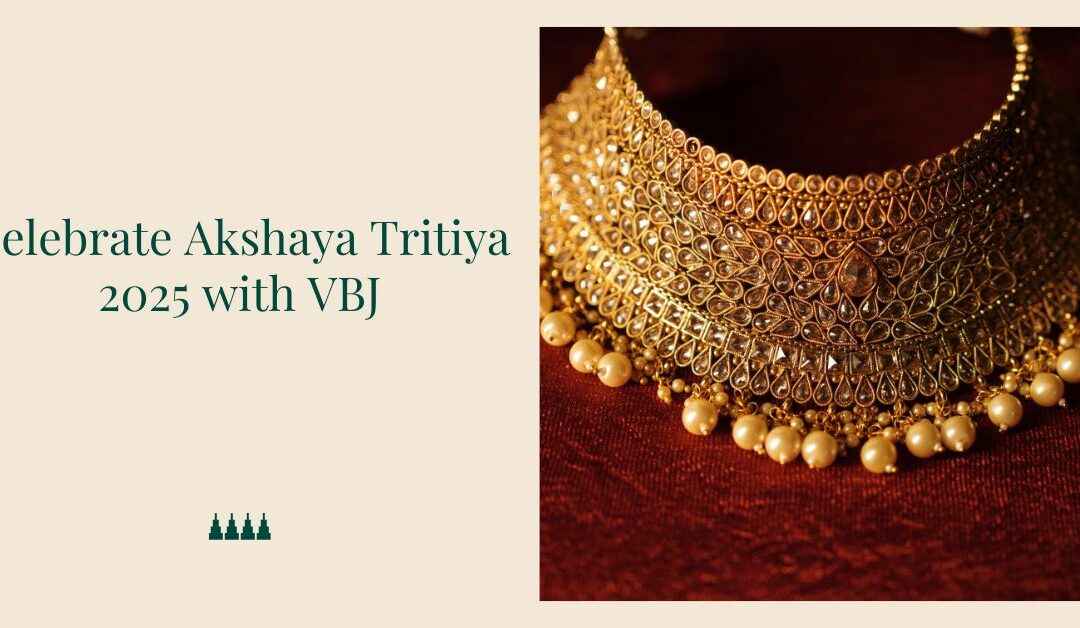

Gold is a great investment and its returns depend upon its purity. As mentioned above, gold bought in the form of bars is the best investment and the best place to buy them is Vummidi Bangaru Jewellers.

Vummidi Bangaru Jewellers popularly known as VBJ has its store in the heart of Chennai city. Since it opened in 1900 it is known for its authentic gold material. Be it jewelry or gold bars it ensures promise of quality and distinction. You can be sure of the trust VBJ promises and you will never regret it in future.

Key Takeaway

Gold investments are done by people or investors who care about their financial security and want to preserve and accumulate their capital. Gold bars are the most preferable option.

The bars are known for their purity and strict standardization. It contains 99.5% to 99.99% pure gold. And the manufacturing cost is much lower than it takes while making jewelry.

Point to be noted – Gold investments are a long term investment and not a get-rich-quick scheme.

| For Latest Updates and Trends Checkout Official Vummidi Bangaru Jewellers Instagram Page |

FAQs Related To Mistakes to Avoid When Investing in Gold

1. Why is a 1 gram gold bar better than 1gram gold jewelry?

A gold bar weighing 1 gram is much more valuable than gold jewelry of the same weight as jewelry is made with the addition of other metals to create alloys that improve strength, durability and facilitate further processing. And 1 gram gold bar is 24K pure.

2. Is it a good idea to invest in gold?

Yes, it’s a good idea to invest in gold. It not only diversifies your portfolio but also acts as a hedge against inflation.

3. What is the basic difference between investing in gold and the stock market?

Gold investment is a long term investment and stock market is both long term and short term investment. Though the common point between them is they can be sold whenever you require.

4. Which gold is good to buy?

24K gold offers unmatched purity and liquidity, making it ideal for pure investment purposes.

5. How to know gold purity?

Hallmarks are symbols imprinted on gold jewelry indicate purity and authenticity.

Store Locator

Store Locator

0 Comments