For centuries, the glint of gold has mesmerized Indians, adorning weddings, temples, and hearts in equal measure. But beyond its cultural significance, gold has played a vital role in the Indian economy, acting as a reliable store of value and a refuge in times of turbulence. As we usher in 2024, amidst global uncertainties and domestic aspirations, the question arises: Should gold find a place in your Indian investment portfolio?

The answer, as always, is multifaceted, but the compelling reasons for considering gold in the current Indian context might just make you say “shubh laabh” (auspicious profit).

Reasons To Invest in Gold in 2024

1. A Safe Haven in Turbulent Times:

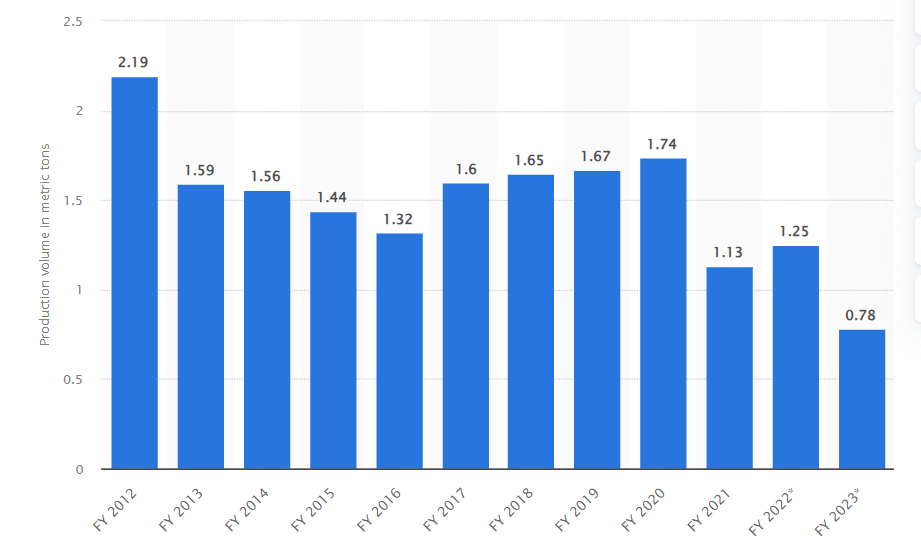

India’s economic landscape in 2023 is marked by rising inflation, a depreciating rupee, and geopolitical tensions. These factors, coupled with ongoing global market anxieties, create an environment where safe-haven assets like gold shine. Historically, gold prices have shown positive correlation with inflation and economic uncertainty. In the past five years (2019-2023), while Indian inflation averaged 5.6%, gold prices appreciated by 26.3%, offering investors a valuable hedge against their purchasing power shrinking.

This stability during market fluctuations makes gold a valuable diversifier within an Indian portfolio, reducing overall risk and providing peace of mind during turbulent times.

2. Rupee Hedging:

The Indian rupee has experienced its fair share of depreciation in recent years. This can significantly impact returns on investments pegged to foreign currencies. Gold, however, offers a natural hedge against a weakening rupee. Its price in INR tends to rise when the rupee falls, protecting the value of your investment. In the past five years, while the rupee depreciated by 11.2% against the US dollar, gold prices in INR appreciated by 30.2%.

3. Cultural Significance and Festive Demand:

India’s cultural and religious sentiments make gold an integral part of life. From auspicious occasions like weddings and festivals to gifting and inheritance, gold plays a pivotal role. This consistent domestic demand ensures a stable floor for gold prices in the Indian market, even during global downturns. In 2022, despite a slight dip in global gold prices, India imported a record 852 tonnes of the precious metal, driven by the festive season and Akshaya Tritiya celebrations.

4. Diversification and Portfolio Optimization:

While the Indian stock market has offered impressive returns in recent years, it is also known for its volatility. Adding gold to your portfolio can help mitigate this risk by diversifying your assets. Gold’s low correlation with equities means it can act as a counterweight during market downturns, protecting your overall portfolio value. Research suggests that allocating around 5-10% of your portfolio to gold can significantly improve risk-adjusted returns.

5. Multiple Investment Options:

Investing in gold in India goes beyond the traditional gold bars and ornaments. Modern investors have a plethora of options, including:

- Gold ETFs: These offer convenient and cost-effective exposure to gold prices without the need for physical storage.

- Sovereign Gold Bonds: Issued by the Government of India, these offer guaranteed returns with capital protection, making them a low-risk option.

- Digital Gold: Platforms like Paytm and Augmont allow you to buy and sell gold fractions digitally, providing unparalleled accessibility and liquidity.

A Word of Caution:

Like any investment, gold is not without risks. Its prices can be volatile in the short term, and factors like rising interest rates or a sudden improvement in global economic conditions could trigger price corrections. Additionally, storing physical gold requires secure arrangements and carries associated costs.

The Golden Takeaway:

Investing in gold in India in 2024 is a strategic decision, not a get-rich-quick scheme. If you’re looking for a long-term asset that can act as a safe haven, hedge against inflation and rupee depreciation, diversify your portfolio, and tap into cultural significance, gold deserves serious consideration. However, thorough research, understanding your risk tolerance, and consulting a financial advisor are crucial before making any investment decisions.

Remember, just like gold, a well-crafted investment strategy requires patience, a keen eye for opportunity, and a touch of calculated risk. So, should gold sparkle in your Indian portfolio in 2024? Let the facts, your financial goals, and a sprinkle of golden foresight guide your path.

Store Locator

Store Locator

Keep up the great work! Thank you so much for sharing a great posts.